At Upturn, we secure debt and equity financing for renewable energy projects from local and international sources. We focus on medium to large projects (typically nominal capacity of 1MW and above) in solar and wind energy parks. We work with you to determine the optimum financing structure for your project, based on the project itself, the participants and the financial conditions that prevail at the time of the project.

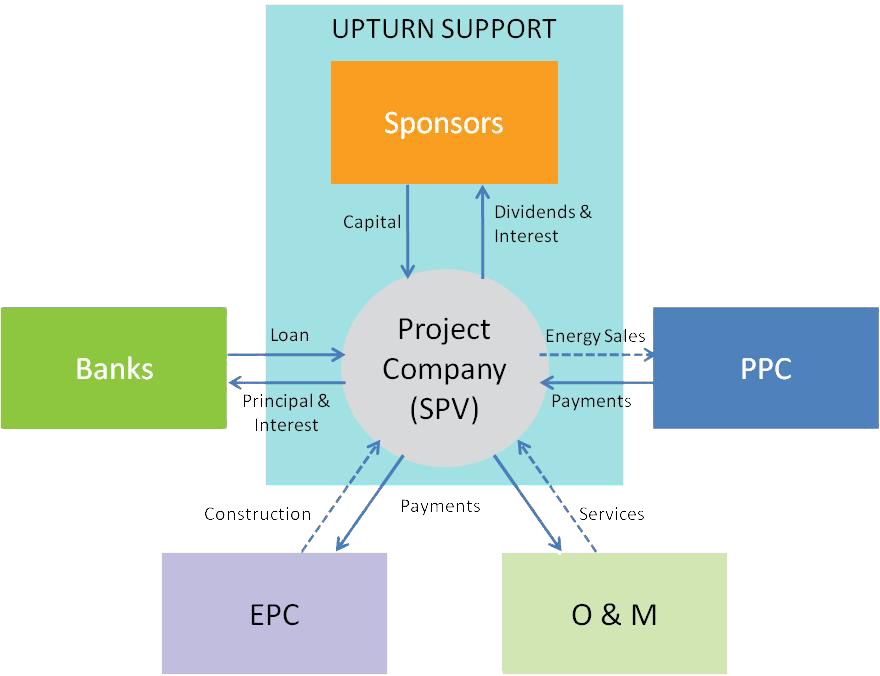

As with many infrastructure projects, capital intensive energy projects are often financed as stand-alone entities (Project Finance) rather than as part of a corporate balance sheet (Corporate Finance). The main advantage of project finance is there is no or only limited recourse to the project sponsor's assets for the liabilities of the project. Instead, Banks place a substantial degree of reliance on the performance of the project itself.

At the heart of the project finance transaction is the project company, a Special Purpose Vehicle (SPV) that consists of the shareholders who may be investors or have other interests in the project (such as contractor or operator). The SPV is created as an independent legal entity that enters into contractual agreements with a number of other parties necessary in a project finance deal. All parties (e.g equipment manufacturers, constructors, operation & maintenance providers) have to be well-known, with proven track record of delivery on similar projects and a solid financial basis.

Upturn commences the financing process for your renewable energy projects with an in-depth review of your project and your requirements. We work with you in structuring a successful project that will be well-received by reputable financial institutions. We evaluate the components of the project and take actions to mitigate risks.

This approach, along with solid financial analysis of your project and our established relationships with funding sources (banks, private investors, public companies, funds, agencies), enhances your project’s possibilities of securing competitive financing terms.

Typically, we help our clients secure project financing for medium to large Solar and Wind projects (total budget of more than 3 million Euros) with very favorable terms.